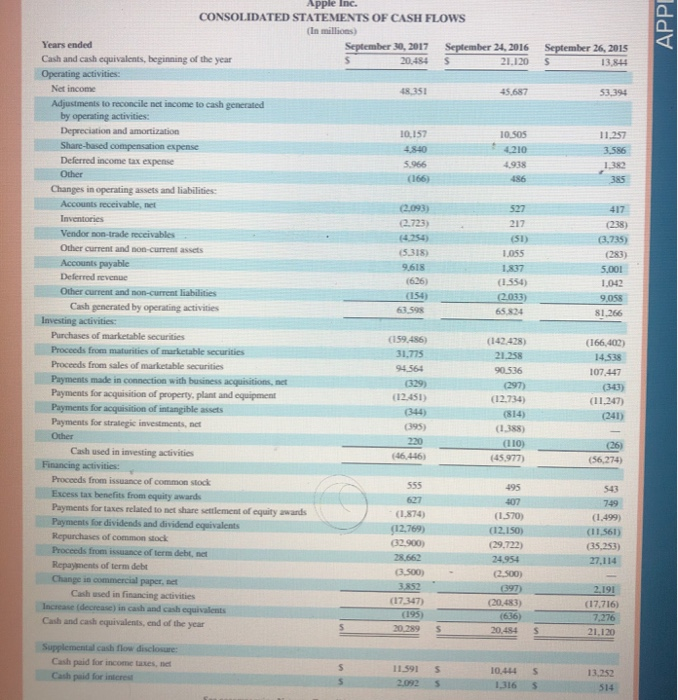

In the Income Statement this will be an entry under the “Interest Expense”.In Apple's Statement of Cash Flows, it is under the “Supplemental Cash Flow disclosure” & this entry will be affected only after the amount is paid. Interest to be paid comes under “Cash flow from operating activities”.According to the third quarter Cash Flow statement Apple has cash & cash equivalents of USD $18 billion and can pay this tax amount.In its 2nd quarter 10-Q filing in 2015, Apple had addressed this issue as “material”* tax repercussion.The back taxes are for a period of up to 10 years. Apple has been making provisions for taxes accrued.The $14.5 billion back tax bill is barely 10 percent of Apple’s offshore tax holdings.As of 2014, Apple was paying tax at the rate of 0.005%. Apple was paying taxes at rates far lower than the already low Irish corporation tax rate of 12.5 percent.The European Commission has asked Apple to pay $12.5 billion worth of back taxes on behalf of its companies Apple Sales International and Apple Operations Europe, two Irish-registered companies, which hold the intellectual property to Apple products and brands outside of North and South America.Determination of Market CapitalizationĪs of SShares outstanding in million : 5.58 billionĬlosing Stock price of Apple on Sept 25, 2015: $ 116.28īook Value per share = (Total Asset - Total Liabilities)/Total shares outstanding: 21.39 A negative cash flow from the financing activities section shows cash from from issuing and paying off outside financing.Ĥ. A stable or growing business typically has a negative net cashflow from investment activities due to buying more assets than it sells. In addition to a positive cash flow from operating activities a negative cash from from investing and financing activities is a sign of strength. Their cash flows from operating activities have grown over the last 3 years with an 11.3% increase from 2013 to 2014 and a 36.1% increase from 2014 to 2015. Even with negative cash flows from investing activities and financing activities, Apple still had a positive overall cash flow. Total cash and cash equivalents increased by 52.6% from 2014 to 2015. Apple’s net cash used in financing activities was -$17,716. They also paid $11,516 in dividends, their second largest outflow. The repurchase of stock was their largest cash outflow in financing activities. They also repurchased $35,253 in common stock. Apple’s net cash used in investing activities was -$56,274.Īpple issued common stock and received $543 as proceeds from that issuance. Their second largest cash outflow was in payments for acquisition of property, plant and equipment, -$11,247. It’s largest cash inflow was from the proceeds from sales of marketable securities, $107,447, meaning the net cash outflow for marketable securities was $58,955. Net income is adjusted for noncash expenses and then for changes in current assets and current liabilities to yield cash flow from operating activities.Īpple largest cash outflow was in the purchase of marketable securities, $166,402. Operating cash, on the other hand, is the net change in cash from the receipts and payments during the period. Net income reports revenues when earned and expenses when incurred, meaning cash may or may not have been received or paid. Apple’s cash flows from operations were $81,266, over 50% larger than their net income of $53,394. Cash and cash equivalents for the beginning of the year was $13,844 and for the end of the year, $21,120. Compared with total comprehensive income of 2014, 2015 is slightly less profitable due to the other comprehensive income loss, but still more profitable than 2013.Īpple had an increase in cash and cash equivalents of $7,276, a 52.6% increase from the previous year's end cash flow. Compared with the net income and gross margin of 20, 2015 is more profitable, because in 2015 Apple spent less in cost of sales and operations, bringing it high gross margin.

0 kommentar(er)

0 kommentar(er)